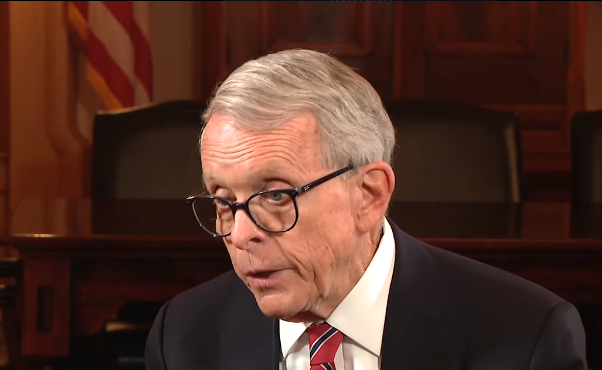

Ohio Gov. Mike DeWine Outlines Final-Year Priorities: Education, Tax Reform & Key Policy Decisions

Governor Mike DeWine Reflects on Final Year as Ohio Governor

Columbus, Ohio – As Gov. Mike DeWine enters his final full year in office, the Ohio leader is outlining his remaining priorities and the major policy decisions that will shape his legacy. DeWine, Ohio’s 70th governor, has served since 2019 and has signed several significant bills during his tenure, such as Braden’s Law, the Parents’ Bill of Rights, and the Protect All Students Act.

In an exclusive conversation, DeWine discussed his focus for the year ahead, emphasizing improvements in education, property tax reforms, and essential support for Ohio families.

DeWine on Maximizing His Final Year

DeWine says he approaches each day with urgency, even keeping a countdown clock on his desk to remind him of how much time remains. His goal is to “finish strong” by advancing the initiatives he believes will most impact Ohioans.

A major focus is the statewide implementation of the science of reading, a research-backed approach to improving literacy outcomes. DeWine shared that many new teachers were not receiving adequate training on the method, prompting the state to require all teacher preparation programs to adopt it.

Another priority is the state’s vision screening program, which provides eye exams and glasses to children. DeWine highlighted that many students who need vision care don’t receive it, and the administration is working to expand screenings across the state.

Property Tax Reform: A Growing Concern

DeWine acknowledged that rising property taxes are driving some Ohio residents out of their homes. After vetoing earlier reform bills that he felt would negatively affect schools, he formed a working group of auditors and educators to analyze the issue. Their recommendations resulted in four new legislative proposals that DeWine is currently reviewing.

The governor emphasized the challenge of balancing school funding with taxpayer relief, warning that eliminating real estate taxes entirely would require steep increases in other taxes.

School Funding Responsibilities

Addressing concerns from Columbus City Schools and other districts, DeWine noted that while the state provides significant funding, completely removing property taxes would destabilize school budgets. He emphasized the importance of maintaining a balanced, sustainable funding model.

Death Penalty Pause & Future Decision

Ohio’s execution process remains paused due to drug access issues. DeWine explained that pharmaceutical companies warned the state against using their medications for executions, making lethal injection unfeasible. He plans to publicly outline his position in the coming months, though the legislature will ultimately decide how to proceed.

Signing Senate Bill 56 on Intoxicating Hemp

DeWine confirmed he will sign the bill banning intoxicating hemp products, citing concerns about underage access and rising emergency room visits among children.

Absentee Ballot Grace Period Debate

He is also reviewing legislation that would eliminate the four-day grace period for absentee ballots mailed before Election Day. With the U.S. Supreme Court reviewing a similar case, DeWine says the decision requires careful consideration.

Looking Back at the Year

DeWine highlighted the new scholarship program for Ohio’s top graduating students, offering $5,000 per year to encourage them to attend college within the state as a major achievement. Retention of top-performing students has already increased.

Though not all proposals have been passed, DeWine says he remains determined to continue pushing forward until his final day in office.